Path novice trader. What is it?

Path novice trader. What a novice trader faces, and what steps it needs to go.Almost every person who trades the forex or stock exchange, as a beginner or a professional, begins to engage in trading only for one purpose - to make as much money, and to radically change their lives (do not believe, if you say in another) .

Even if a man and began to learn

trading, only to master the new to the profession, to study and to understand the international

market, or simply in order to get additional source of income, with the

trade over the years of the trader mindset changes and the only motivation is the opportunity to earn as much money as possible. Another goal is to make money trading the trader can not simply byt.V this kind of business, the

market is still how well you know about the economy, politics, currency markets or other trading "platforms." Most traders are smart people who are well versed in economics, finance, but few of them can really make money in the market. There are many ways how you can get acquainted with this market. To start, you need to find and explore information that will give an understanding of the basics. Learn how the forex or various exchanges, who are the traders, who are the brokers and DC. Then worth exploring as a bargain place, who are the main bidders, what are the costs of trade (spreads, commissions, swaps), which software should be used for trade and t.d.Mozhno course and pass the training course, but in my experience say that nothing they will not tell you and do not give the information that you will not find on the Internet or books. You can also start your career by communicating on the forums, sensible information to find there will be a problem, but in some ways you can understand. After quite a long time to trade forex, and based both on their experience and the experience of their friends-acquaintances, I can say that almost every trader on the road to success passes certain stages through the ordeal that can last for years, but say, the game is worth the candle. Below I will describe them, of course, each person is different, and each may differ slightly (and sometimes dramatically), and take a different period of time. Stage №1.Odin click on the banner ad may give you the opportunity to work in one of the most exciting areas, you have the opportunity to learn many things that you would not have learned in any other sphere, or any other work! One mouse click can give you the ability to do what you want, you do not work on anyone, in practice it you gives freedom! You've been reading a bunch of positive, we heard that many earn their trading a lot of money, open your first deposit, see the graphs view everything is simple, the

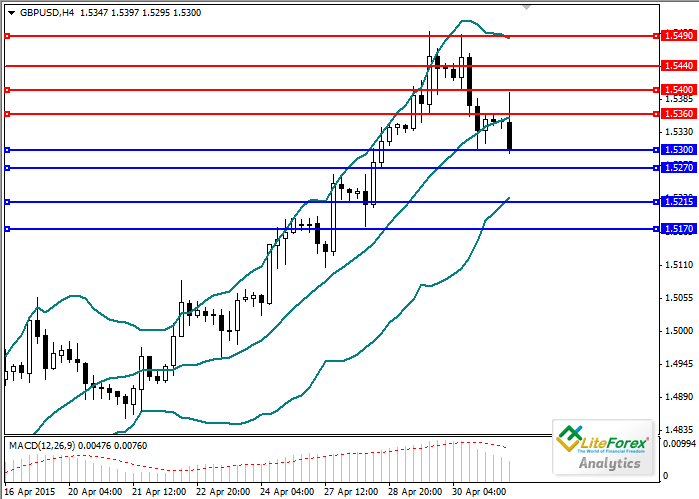

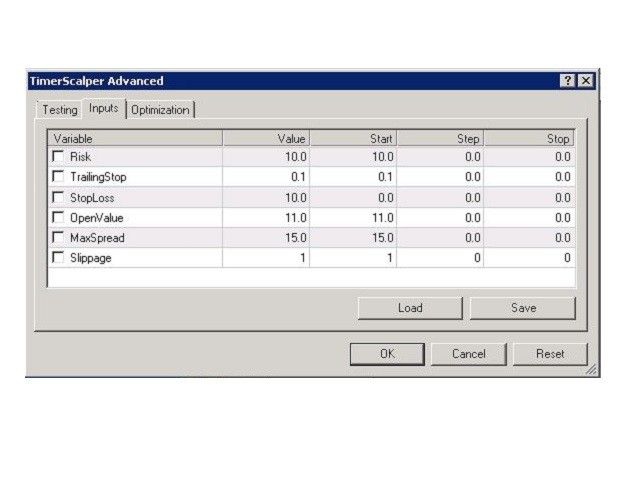

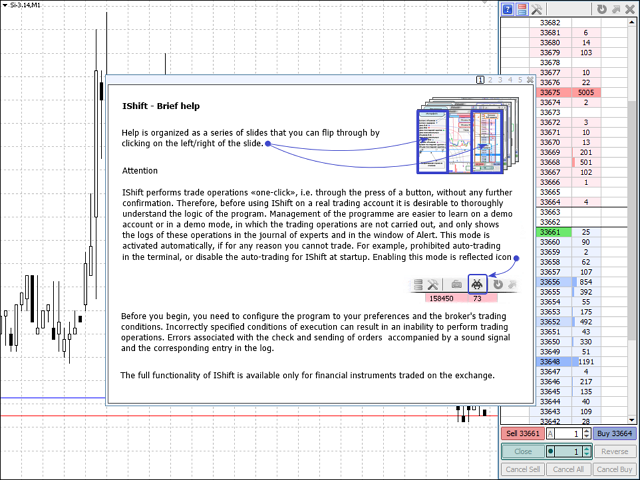

price goes up - down, bought, sold, which is easier! It remains only to buy more and shovel to paddle dengi.Estestvenno that you do not know anything about any market, nor about such concepts as the spread, of any trading method only trading platform in front of the eyes and alluring buttons buy-sell.Obychno when rookie opens his first position, he did not have the slightest idea of what he wants, and why it is such a position opens. It takes on disproportionate risks. All similar to roulette, where the odds are not in his polzu.Samoe worst thing in this case can happen - it is luck, and when a beginner wins (it wins, with this trade has nothing to do), then he thinks that everything is very simple and It takes on even greater risks. The first time a newcomer moves excitement and euphoria, one of the most destructive emotion for treydera.Esli the market goes against you, the young trader adds position, averaged (without even knowing that it is so called) and he may be lucky, but luck everyone comes to an end. I doubled your first deposit, and then merged in one transaction (thought that simply can not go wrong, just everything is so easily obtained earlier). Over time, a novice to go down a deposit. For a day or two, a week, a month. You can then open a new deposit, and again drained it. Then there is a feeling that something is still lacking. ... And only then, are new moves to the second stage. Stage №2.Na second level comes the realization that things are not so simple. You begin to understand that the need to study and work. You begin to understand that the skills to keep the profit you just net.Novichok begins in a chaotic manner to look for different trading systems, buy advisors, seek video courses, a variety of indicators. Almost every day to change a variety of

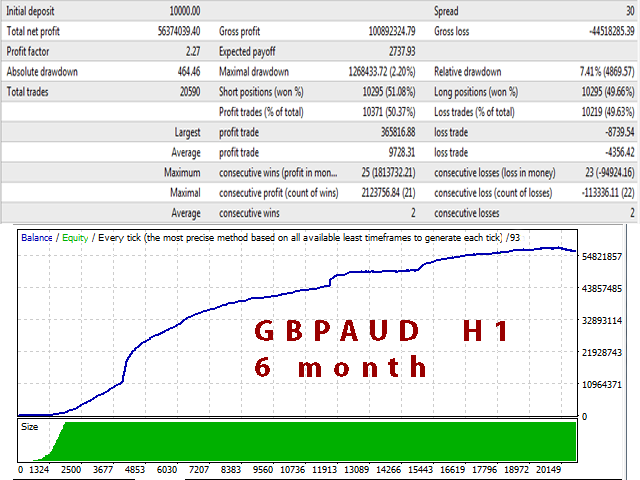

trading strategies, so not really one, and was not tested. Begins to "play" with Moving Averages, Fibonacci, divergence, stochastic fractals, resistance and support lines in the hope of finding exactly what might be called the "Holy Grail" of the trader. Begins trading only on the basis of indicators with great confidence in making a profit, while ignoring and increasing its loss-making position, because now I can not go wrong! Frantically looking for a variety of forums, chat rooms where talking traders, ask a million questions, but so sure of their correctness, and that you know everything better than others, do not listen to the advice of people who have long traded and that is that they should know, and continues to bend his line and stopped believing in what they earn, because you're so much already studied and ne eproboval, but you do not get! The man with the experience of trade only smiles in such a novice, you okreschivaet Gamblers, and recalls how he so byl.V panic, beginner can find a guru, and give him a lot of money for the sake of what he is taught, but it did not really comes because you are still sure that you are smarter and better to know for whom the libo.Etot stage can last long enough, a year, two, three. According to statistics, 60% of new traders leave the market during the first 3 months, another 20% over the year, while the rest remain and continue to "butt heads" with the market. 3-4 years only 5-10% remain stable and are already beginning to zarabatyvat.Obychno coming up to the third stage, you have already merged 3-4 depot (and maybe more) got into debt or loans (highly unlikely to

trade in the "foreign" money ). Not once has let down his hand, but still you're still derzhishsya.I one day beginner moves on the third stage. Stage №3.Na this level, you've come to realize that it's not just in the system. Profits can be obtained even trading without indicators, integrals, fractals or other beautiful and incomprehensible lines and zakarlyuchek, the main thing here to skillfully manage their emotions and such natural human vices like greed and fear. You begin to spend more time on more competent risk management, studied in books trading psychology, and you realize how many mistakes you can not allow reaching you of it before! Just did swallow competent books on trading, without which it is difficult to become a professional trader (of course, you can cope without them, but it goes much longer), you analyze errors traders are doing it all my life to you. Personally, I books helped a lot to understand and prevent a lot of mistakes I could make a career on traders. The mistakes of others more pleasant and less learning.

It is impossible to predict every movement of the market, at any minute, any hour. After that, the need for the study of intelligence from all the guru you simply disappears. It begins trading on its own

trading system, which is suitable only tebe.Nachinaetsya more systematic trade, you begin to open positions only on its strategy and the only ones that you think are more likely to succeed. If the market went against your position, you are without unnecessary emotions, curses and hopes for a reversal to close a position (to persuade and to belittle the market is meaningless, it is unlikely he listens to your requests and will develop, personally tested many times). You just when the next signal will open a new position, the main thing to know and be sure that your system is running and profitable. One of the basic rules of trading states "do not argue with the

market, the market is always right" .Treyder begins to analyze the results in a week, month, quarter, he already understands that one losing trade does not mean anything. You begin to understand that success in trading depends on the discipline and control of emotions, and if you trade the system, it will make a profit (if indeed operating system). In this case, advantage probability will always on your side. Step 4 №4.Na step, have you open the transaction strictly in their system, only a signal, you learn to move close both unprofitable and profitable trades. Not panicking, let profitable trades to grow, and quickly closes unprofitable, as you know, that your system is already paying more money than teryaet.Na this stage you already receive a steady income, at least you are in bezubytka. Of course, this is not the last step, you will still have a lot to think about, a lot to try and explore, but the main thing that you will not lose dengi.Etot level usually lasts about six months. The hardest part is over. Step №5. Posledniy.Torgovlya acquires more than ordinary character, you trade already on autopilot, making deals. There comes a time of big profits, but they have not driven you into euphoria. According to the pro trader can not be understood, he has earned or lost 5 thousand dollars per day. Trading becomes a routine, at work, that does not mean in an interesting and profitable rabotu.No the trader stops, every day he corrects his trading strategy, making the finishing touches, but the method of

trading does not change, it just gets better. There are so-called traders intuitsiya.Vsegda need to remember that only 5-10% of traders reach Stage 5, not because it is so difficult and not everyone can, and because they do not all have the strength and perseverance to change themselves and change their views with the arrival of new information. To become truly successful traders need to not only get rid of his "I know better" and the desire to get rich quickly, and need to work and learn, every day to improve themselves in the art of spekulyatsiy.V conclusion, I would say that does not necessarily need to be a super genius or intellectual to cash in on the market, often those who possess such qualities as patience and perseverance, achieve far greater rezultatov.Treyder loser of a successful trader is different only in that the first conc iruetsya only profitable transactions, while the pro increasingly focused on losing trades and the rules manimenedzhmenta.Finansovye markets are, in principle, business and sports like persistent and enthusiastic people who are ready to go to the end, despite all the obstacles. Who perceives trading as a game, and he gets a result. Trading can be compared with the difficult, long marathon, which will overcome every, but the reward at the finish line just worth all the traversed path.

P.S. Also do not forget that the success of the financial markets needs is another important aspect - honest and reliable broker. How would you not trade, the kitchen can reduce all efforts to nothing. About how to choose the right broker, you can read in my other articles. And yes will arrive with us passing trend!

The original and the other articles

Related posts

Trading Psychology first 3 points

Trading Psychology. The first 3 points of immortality. Today is not an ordinary article, which says that everyone knows, but can not win everything....

Price Action from Nyala Fuller

Price Action from Nyala Fuller How to create your own trading plan I found that most traders do not have a trading plan, they do not know how him to do,...

Computing power of market structu

The computing power of the market structure Now we know that the market is an efficient machine for the distribution of funds between the parties. Now...

Next posts